Infosys to Acquire Leading Engineering R&D services provider, in-tech

Infosys a global leader in next-generation digital services and consulting, today announced a definitive agreement to acquire in-tech, a leading...

Thursday, 18 April 2024, 06:33:46 PM IST

Is Travel Insurance Mandatory For a US Visa? Know its Benefits and More

Preparing to visit the US? Great! Well, we hope you know that the US is a vast place that receives millions of tourists annually. The place offers...

Thursday, 18 April 2024, 04:40:21 PM IST

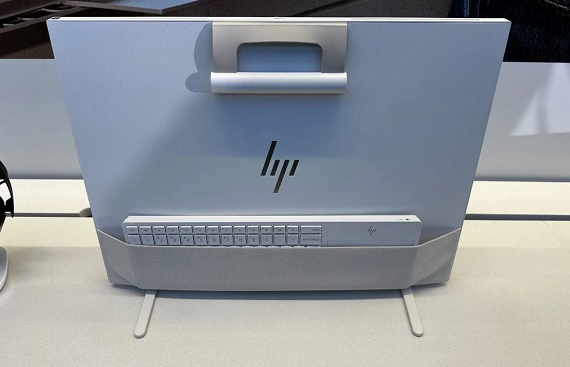

HP Launches 'Innovation & Digital Education Academy' in India

HP has launched the 'Innovation & Digital Education Academy' (IDEA) programme in India, aimed at equipping educators with essential digital...

Thursday, 18 April 2024, 02:56:11 PM IST

Meet Prime Astrology Expert in India 2024

Vedic astrology, deeply ingrained in Indian culture, remains significant in modern society. Over generations, people have admired celestial...

Thursday, 18 April 2024, 02:54:43 PM IST

Indian Electronics Industry Witnesses 154% Growth in Hiring and Skilling

The electronics industry in India has witnessed a staggering 154 percent surge in hiring and skilling activities during the last financial year, marking a remarkable growth trajectory from March 2023 to March this year. According to a report by...

Hyundai Verna vs Creta - How Hyundai's Sedan & SUV Compare on Price, Mileage & More

Sedans and SUVs have their merits, appealing to different drivers with diverse needs. Hyundai offers popular models in each category - the graceful Verna sedan and the capable Creta SUV. Looking at factors like pricing, fuel efficiency, space,...